A few years ago, I received MatchX.io MatchBoX outdoor LoRaWAN gateway for review, and eventually tested it with RAK811 LoRa tracker once I got a node to play with, and made sure I did not break any local laws.

But now the company has come up with an unusual gateway with its MatchX M2 Pro LPWAN Crypto-Miner that acts as a traditional LoRaWAN gateway, as well as a cryptocurrency miner. I’m a bit perplexed by the solution as miners are notoriously power-hungry, but let’s have a look.

MatchX M2 Pro specifications:

- SoC – NXP i.MX 6UL (MCIMX6G2CVM05AB) single-core Arm Cortex-A7 processor @ up to 528MHz

- System Memory – 256MB DDR3 RAM

- Storage – 256MB NAND FLASH, optional SSD up to 32GB or industrial SD-Card

- Networking & Wireless Connectivity

- LoRa Radio – SX1302 chipsets, 16 frequency channels Supports EU868, US915, AS920, AS923, AU915, KR920, IN865 regions

- 2.4Ghz 802.11b/g/n WiFi 4

- GPS via UBlox Max 7Q GNSS receiver with additional LNA

- 10/100 Mbit Ethernet with 24V POE support

- 4x SMA waterproof antenna connectors

- USB – 1x USB Type-C port with USB PD power and console UART support, 1x USB Type-A host port

- Sensors – 3-Axis accelerometer, pressure sensor, temperature sensors, voltage, and current monitoring

- Misc – Reset Button,

- Power Supply – 24V DC passive PoE or USB-C PD rev 2.0 up to 22V

- Power Consumption – 3.5W on average, peak 6W

- Temperature Range – -40ºC to 85ºC

- Enclosure – ASA plastic, anti-UV

- Dimensions – 226 x 101 x 73mm (without antenna)

- Weight – 400 grams

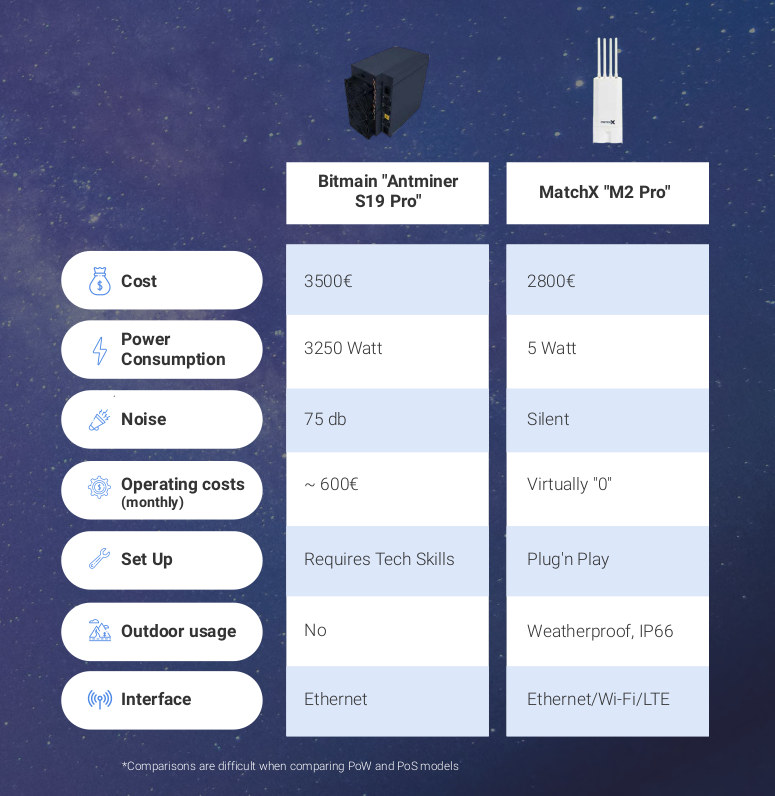

There’s no ASIC for cryptocurrency mining, and from a hardware point-of-view, this looks like a typical LoRaWAN gateway. But then we have this comparison table between a crypto-miner and MatchX M2 Pro gateway.

That looks like a non-sensical comparison to me as besides the acquisition cost of ~3,000 Euros, both are completely different beasts. But I think the important part is at the asterisk under the table: “comparisons are difficult when comparing PoW and PoS models”. I’m not really knowledgeable in cryptocurrencies so let’s find out what this means:

In POW (Proof-of-Work), the miners solve cryptographically hard puzzles by using their computational resources. In POS (Proof-of-Stake), instead of miners, there are validators. The validators lock up some of their Ether as a stake in the ecosystem. Following that, the validators bet on the blocks that they feel will be added next to the chain. When the block gets added, the validators get a block reward in proportion to their stake.

So the way I understand it, PoS does not require lots of processing power, while PoW used with cryptocurrencies such as Bitcoin does. This seems much more sustainable since Bitcoin’s electricity consumption matches the one of the Czech Republic as of August 2020.

If you read further we’ll find out MatchX M2 Pro relies on MXC DataDash App for Android and iOS which allows you to monitor your earnings via MXC, a “secure and reliable cryptocurrency exchange for trading Bitcoin, Ethereum, Litecoin, EOS, TRON, USDT, XRP, etc”.

So I suppose companies can set-up a network of MatchX M2 Pro LPWAN crypto-miner gateways in order to get some income from their gateways. There’s no mention of expected returns, and if I understand correctly it will depend on the number of transactions going through the gateway. The company claims over 20,000 LPWAB crypto-miners have been pre-order so far. More details may be found on the product page.

Jean-Luc started CNX Software in 2010 as a part-time endeavor, before quitting his job as a software engineering manager, and starting to write daily news, and reviews full time later in 2011.

Support CNX Software! Donate via cryptocurrencies, become a Patron on Patreon, or purchase goods on Amazon or Aliexpress

I think they forgot to include the fact that the value you can expect from any mining with this device will be similar to the operating costs — virtually zero.

“Mining” looks like more of a marketing gimmick

I’ve been talking with another LoRaWAN vendor today, and there are other solutions similar to MXC. The income really depends on the location of the gateways, Since it’s based on blockchain technology everything is public, and one company/individual? with 60+ gateways is making close to $50,000 a day. Not too shabby. I’ll probably write more about it tomorrow.

So over $18 million a year? Sorry, I don’t buy it.

If it sounds too good to be true, it probably is.

The “Mining” terminology that’s used in the context of the MatchX M2 Pro is just for marketing purposes, it’s actually just a form of staking (locking tokens in exchange for rewards). See this link where it clearly states that “MXC can not be mined” https://blog.mxc.org/mxc-staking-mechanism-explained/.

The MatchX M2 Pro is an LPWAN Gateway (for uplinking IoT data shared from IoT end-devices). The MatchX M2 Pro doesn’t allow you to run an “on-chain” full or archive node as a PoW miner (like the Bitmain Antminer S19 Pro does), nor does it let you run an “on-chain” PoS validator full node or archive node where you’d stake tokens to try to earn the block reward.

The Bitmain Antminer S19 Pro is an actual ASIC mining server machine that’s exclusively for mining coins that use the SHA-256 algorithm.

Instead, users of an MXC Supernode may earn reward tokens in return for the opportunity cost of “Staking” (i.e. locking) tokens for a period of time in an “on-chain” smart contract on the Ethereum network for a period of time that’s associated with an “off-chain” MXC Supernode that they’ve chosen to invest in, and they may also earn reward tokens for registering an MatchX M2 Pro with an “off-chain” MXC Supernode.

The MXC Supernodes process machine-to-machine bids (which are referred to as “contour payments”) in the “sharing economy” between LPWAN IoT end devices (that wish to share data they’ve collected) and LPWAN gateways (that expect payment in return for sharing sending/uplinking that data to the cloud for use in websites and applications on the internet).

3 use cases I suspect are behind its popularity:

1) plug this into power outlet of some high-visibility / high-altitude building and use the cryptocurrency as kickback to the sponsor of the power in exchange for the LoRaWAN service you get.

2) plug this into power outlet of some unwitting company, get LoRaWAN service and offset the risk of your equipment being found and taken by stealing the cryptocurrency (as well as the power)

3) as purchaser for company, buy these to provide the company’s LoRaWAN functionality and steal the cryptocurrency.

Is it what Helium is also doing?

I’ll be interested to know more, can you please investigate?

Yes, correct. The numbers I provided above are for Helium. I plan to write about it later today.

Most crypto exchanges such as upbit take advantage with customers funds because they feel these customers don’t know how to get their funds back, But trust me there are hidden ways you can get your lost funds back from the broker. I was able to withdraw my 7BTC from upbit, If you want to recover your money back then mail fightingscams@Aol, com.